MEET & GREET With Jill

MEET & GREET

Attend One Of Jill's Local Workshops and Receive Updates and Announcements 100% FREE!

September 26, 2024

10 am - noon

Auburn Annual Health Fair

Auburn Senior Center Gym 808 9th St SE, Auburn, WA 98002

October 5, 2024

1 pm - 2:30 PM

Auburn Public Library

1102 Auburn Way S,

Auburn, WA 98002

October 24, 2024

11 am - 2:00 PM

Health & Wellness Fair

25035 104th Ave SEKent, WA 98030

Sponsored By:Cogir of Kent, Senior Living

Jill Clifford , Managing Agent

Join Jill at one of her local upcoming events!

Jill Will Be Covering:

* "ABCD's of Medicare" * Free Educational event on the basics of Medicare and your choices for coverage

* No cost nor obligation

Articles Quick Access

The ABCD’s of Medicare – Medicare Supplements by Jill Clifford

One Medicare coverage choice is keeping original Medicare Parts A and B, plus Part D (or other credible prescription drug coverage), and adding a Medigap policy, also called Medicare Supplement plan. Today, we will cover functions of Medigap plans. In Part 3 of the ABC’s of Medicare, we will cover pros, cons, and factors to consider when selecting a Medigap plan.

To enroll in a Medigap plan, an individual must have Medicare Part A and B. The individual must pay the monthly premium for Part B, $164.50 in 2023, as well as a Medigap premium. It is illegal for anyone to enroll an individual into both a Medicare Advantage plan AND a Medigap plan.

Medigap plans are policies sold by private companies to help pay for "gaps" left by Original Medicare, such as remaining health care copayments, coinsurance, and deductibles. The Omnibus Reconciliation Act of 1980 brought Medigap insurance under federal oversight, creating a minimum standard of coverage for the different supplement plans which all private companies must meet. Any Plan G, for example, must cover the same basic benefits as any other Plan G. Variations in plans result from company strength, customer support, premium costs, rate increases, including any rate “freezes,” and added benefits.

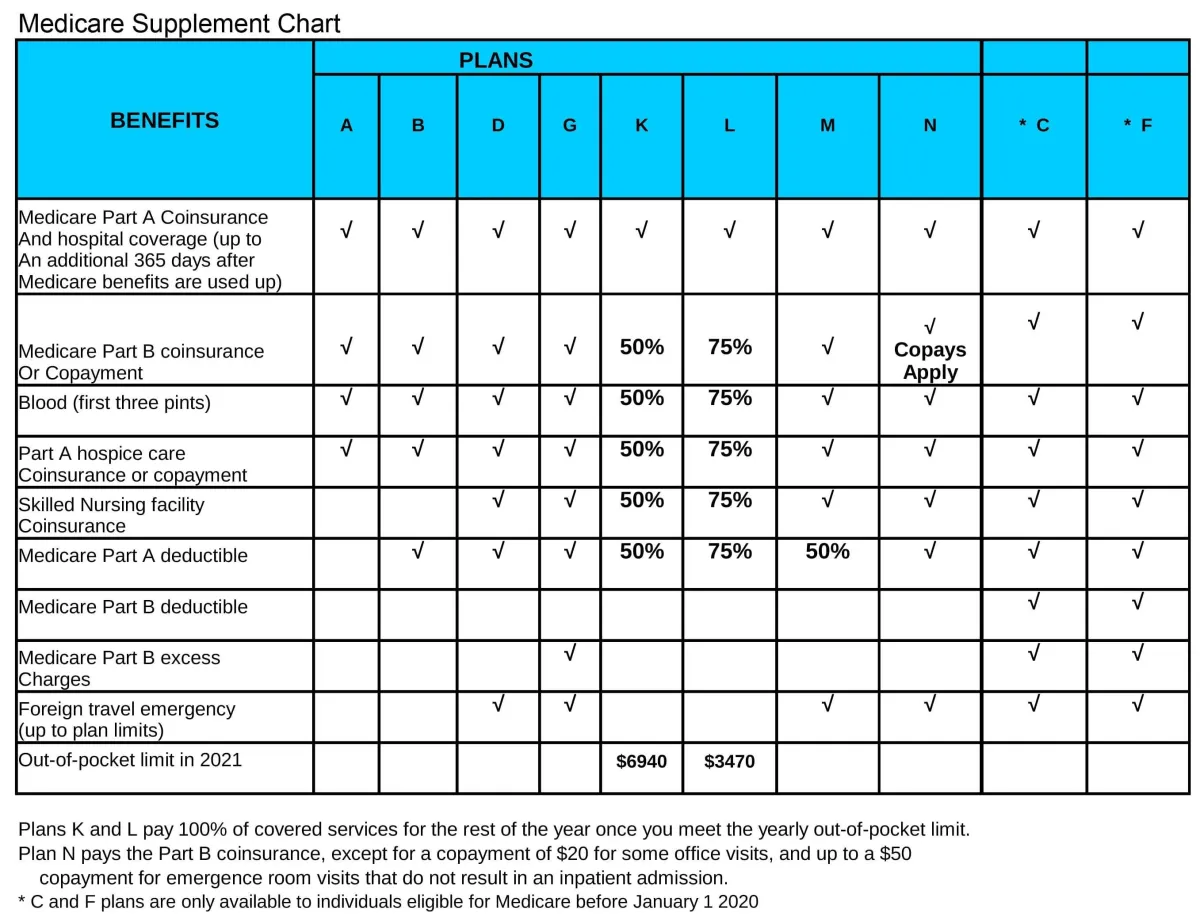

The Supplement plan chart illustrates plans available today (Plan A through Plan N). Plans C and F, the only ones that paid the Part B deductible ($226 in 2023), are no longer available to new applicants. However, anyone currently enrolled in Plan C or F may remain, and individuals who were first Medicare eligible before January 2020 may still enroll in those plans.

Medigap policies may be issued either guaranteed or underwritten. Individuals turning 65 or first eligible are guaranteed issue into any plan available. Those losing credible coverage, through retirement for example, may also be eligible for guarantee issue, but plan selection may be limited. Others applying for Medigap plans will be underwritten, meaning applicants are required to answer health history and medication questions. Companies use this information to determine whether to offer or deny coverage, and whether a standard or increased rate will apply if coverage is offered. Rates will increase (usually annually) after enrollment in a Medigap plan. However, an individual’s plan cannot be canceled or incur rate increases as a result of health problems and expenses, as long as they continue to pay both the supplement and Part B premiums.

1. All plans include the hospital coinsurance coverage.

3. Plan L pays 75% of the rest of expenses until a maximum out of pocket is reached of $3470.

4. Plans K and L pay 100% of covered services for the rest of the calendar year once you meet the out-of- pocket yearly limit.

5. Except Plan A, plans cover some or all of $1600 Part A deductible, one to 60 days in the hospital.

6. Excess charges, which occur if a provider does not accept the Medicare approved payment as payment in full, rarely happen, but only Plans F and G covers such charges.

7. Plan N, except for excess charges, offers nearly equal benefits as Plan G, but requires copayments of $20 for any doctor visit, and $50 for any ER visit that does not result in an inpatient admission.

9. Plans F and G also have a high deductible option which require first paying a plan deductible of $2700 before the lan begins to pay. Once the plan deductible is met, the plan pays 100% of covered services for the rest of the calendar year. High deductible plan G does not cover the Medicare Part B deductible. However, high deductible plans F and G count your payment of the Medicare Part B deductible toward meeting the plan deductible.

8. Supplement plans D, G, M, and N offer foreign travel emergency coverage up to plan limits, which original Medicare does not cover. For example, with an annual deductible of $250, the plan will pay 80% of emergency medical costs up to $50,000 when traveling out of the country.